With an Individual Retirement Account (IRA) you can invest in certain assets, like stocks and bonds, with massive tax advantages that help you reap more profits.

With real estate, you can conquer entire neighborhoods, diversify your portfolio, and potentially achieve even more growth.

Thanks to the possibilities of self-directed IRA (SDIRA) real estate investing, you can take advantage of both of these worlds simultaneously.

How exactly does it work?

And how can you get started?

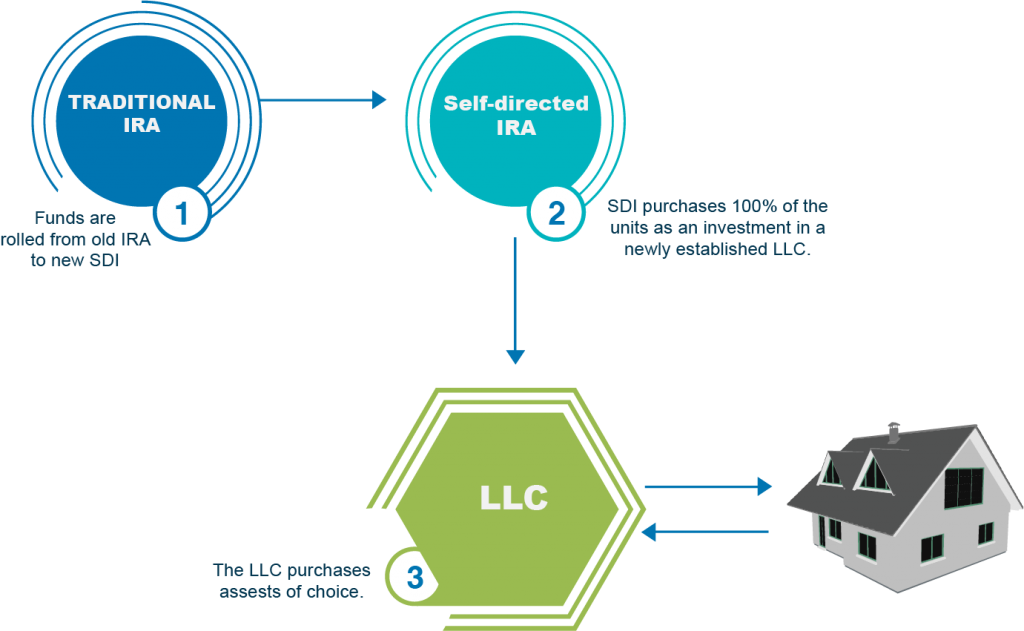

Performing and IRA rollover to a Self-Directed IRA LLC gives the custodian the ability to avoid transaction costs, distribution penalties and custodial delays when purchasing and investing in real estate and small businesses.

A self-directed Roth IRA provides you with broader investment opportunities and enables you to take advantage of investments without having to pay custodial fees or encounter other time-consuming processes.

A self-directed Roth IRA has a number of investment and tax benefits and incentives for the IRA holder. With a self-directed Roth IRA you’re free to invest private and public companies, real estate properties, tax liens, private loans, financial paper, and even franchises. Moreover, your investment returns will occur in a tax-free environment. Apart from enabling a tax-free investment strategy for your portfolio, another important benefit that the self-directed Roth IRA provides is that it can eliminate the fees that are traditionally required of account holders. These fees include transaction, asset-based and holding fees, which you can be exempt from with a self-directed Roth IRA.

In short, your IRA LLC can be less expensive to manage than a traditional retirement account. In addition, you can take advantage of the purchasing power that comes with a self-directed Roth IRA by simply writing a check to invest in the opportunities you see fit, without ever having to pay a income or capital gains tax or have a taxable distribution.

A self-directed Roth IRA, which is nearly synonymous to the Self-Directed IRA, provides the IRA holder with a number of investment and tax benefits, including:

While there are a number of limitations for investing your self directed Roth IRA, the opportunities for unparalleled growth with such accounts can be wildly enormous. To find out more about setting up your own self-directed Roth IRA LLC, please give us a call.

Become the custodian of your own future by grasping control over your retirement funds.

Tax liens, personal loans, private equity, privately-held businesses, and real estate are all areas in which your retirement funds can be put to effective use. With checkbook control over your individual retirement account funds, you can now tap the purchasing power locked within your IRA or 401k. Tapping the power locked in the assets you hold without early distribution and tax penalties is a huge benefit to you and your family. Doing so before you retire will give you more opportunity and control over your destiny.

Often referred to as a checkbook IRA or real estate IRA, this unique financial instrument allows its user to make hard asset purchases on the spot simply by writing a check. As the custodian of your IRA LLC you can now diversify account monies from traditional SEPs, Keoghs, IRAs, 401(k)s, and 403(b)s into more secure, yet highly lucrative investments–all while finding the benefit of tax-deferred profits to your retirement portfolio.

As the custodian and controller of your self-directed individual retirement account, you will glean the following benefits:

While there are some few and limited areas where your checkbook IRA may find To learn how thousands have already made the self-directed IRA LLC the foundation of their financial success.

The almost unavoidable certainty of future increasing investment taxes–some of which is already occurring–has prompted a new wave of IRA rollover techniques for earning tax-free income. The backdoor IRA is one such method. A backdoor IRA allows for movement of monies from taxable, traditional retirement vehicles into a Roth IRA.

This scenario will allow joint filers who report a joint adjusted gross in excess of $250,000 to effectively avoid tax increases set to occur in the near future. It also allows higher net worth individuals to invest using a Roth account where they were previously locked out due to income restraints. Previously, income above a specified threshold precluded some single and joint filers from even obtaining a Roth IRA all together. Now taxpayers, regardless of their adjusted income can perform a rollover to a Roth IRA.

When performing such a rollover, proper steps must be taken to avoid any unnecessary taxes. For instance, specific steps must be taken to avoid prorated taxes based on the amount held in existing retirement accounts. This process requires some somewhat involved, but completely legal work-arounds.

The law is very clear on backdoor Roth IRAs. By filing the proper forms, investors are better qualified to avoid unnecessary taxes on investment income in their retirement accounts. For more information on setting up your own backdoor IRA, please contact us directly.

A real estate IRA allows you make purchases of real estate without incurring distribution penalties, transaction fees or custodial delays. Furthermore, real estate IRAs give you complete control over your investments, including when, where and how you invest your self-directed IRAs.

A real estate IRA from Invest.net will enable you to make real estate purchases within your retirement plan while not having to take taxable distributions or incur any penalties. Moreover, with a will have access to a check book real estate IRA plan that will allow you to make investments simply by writing a check. With real estate IRAs, you will be free from transaction and assets-based fees that are generally incurred by a custodian, and can save thousands. Most of the money in your retirement account from IRAs, 401ks and others can potentially be expanded into more secure and profitable areas, while the tax-deferred profits allow you to increase the funds in your retirement account.

With real estate IRAs, your investment options will include the purchase of real estate, as well as investments in assets such as tax liens, raw lands, personal loans, foreclosures and much more. Each investment can be made conveniently by simply writing out a check, and without incurring and having to pay any fees, including transaction, holding or assets-based fees.

Real estate IRAs enable you to:

A self-directed IRA (SDIRA) is a modified version of an IRA that allows you to invest in things you wouldn't ordinarily be able to use an IRA to invest in. These include assets like private equity, private placements, precious metals, and of course, real estate. In other words, you'll use your tax-advantaged IRA to invest in real estate like:

You can buy residential property for yourself, or to serve as rentals. Residential rental properties are extremely valuable for generating passive income while simultaneously growing in value over time.

You can also use an SDIRA to buy properties you intend to fix and flip. The idea here is to find damaged and degraded properties that you can restore and sell for a massive profit.

Interestingly, you can also use your SDIRA to fund the purchase of commercial properties. Commercial real estate and residential real estate share many advantages, but commercial real estate offers bigger deals, more impressive returns, more stable tenants, and other advantages.

You can even buy raw land and farmland through your SDIRA. This is ideal if you plan on building, developing, or using the land for a specific purpose.

With a Roth IRA, you'll be contributing after-tax dollars and your money will be able to grow completely tax free. With a Traditional IRA, you'll contribute pretax dollars and your money will grow tax deferred. Both types of IRAs are extremely advantageous for reducing taxes, and they can help you grow your money faster and more seamlessly as you approach retirement.

Converting these IRAs into self-directed IRAs allows you to maintain those advantages while also capitalizing on real estate.

There are many new investment options available to you in an SDIRA.

So why would you choose real estate?

So how do you get started with SDIRAs and real estate investing?

Also, keep in mind that it's on you to do all your due diligence when making any investment decision.

Self directed IRA rules have become popular in the recent years as a tool for wealth accumulation in a retirement plan. However, it is important that one understands the limitations associated with his/her IRA. In accordance to the International Revenue Code (IRC), buying of collectibles and life insurance investments are not permissible. On the other hand, you can legally invest your retirement benefits into alternative assets such as real estate, gold mortgages, tax liens, franchise or other small businesses.

As defined by the IRC, prohibited transactions can result from wrong interaction between a ‘disqualified party’ and your retirement plan. A disqualified party as far as self directed IRA rules are concerned is:

Therefore, after considering the above guidelines, a number of prohibited transactions according to the Self directed IRA rules can be derived. Some examples of such transactions include:

Note that prohibited transactions in accordance to the self directed IRA rules are not limited to the outlined ones. The governing criterion is based on the definition given above. In addition, in order to be successful in maximizing your retirement benefits without breaking the self directed IRA rules, you need to understand the above guidelines. You may also seek professional guidance concerning the same if need be.

Why should you choose to work with Invest.net for your SDIRA?

Investing is stressful.

Especially when you’re making big purchases.

At Invest.net, we want to make things easier on you.

That’s why we offer unparalleled self-directed IRA and real estate investment services to help you achieve your long-term goals.

Ready to start the conversation?